ABOUT TPRDC

Our non-profit development company, certified by the U.S. Small Business Administration (SBA), serves as a bridge between local lenders and companies that are seeking commercial real estate financing.

The U.S. Small Business Administration’s 504 Loan Program enables expanding businesses or start-ups to secure long-term, fixed-rate financing for major fixed assets, such as land, buildings, and/or long-term equipment through loans made by the TPRDC.

A typical TPRDC project through the Small Business Administration 504 Loan Program entails a bank loan secured by a first lien covering 50% of a project’s cost. TPRDC then covers up to 40 percent of the cost, and the borrower injects a minimum of 10%. In addition to minimizing your financial burden and enabling you to grow, other advantages include:

Enhanced

Cash Flow

Low Down

Payment

Long-Term Financing at Low, Fixed Interest Rates

Fixed Monthly

Payments

The TPRDC is responsible for…

The TPRDC is responsible for…

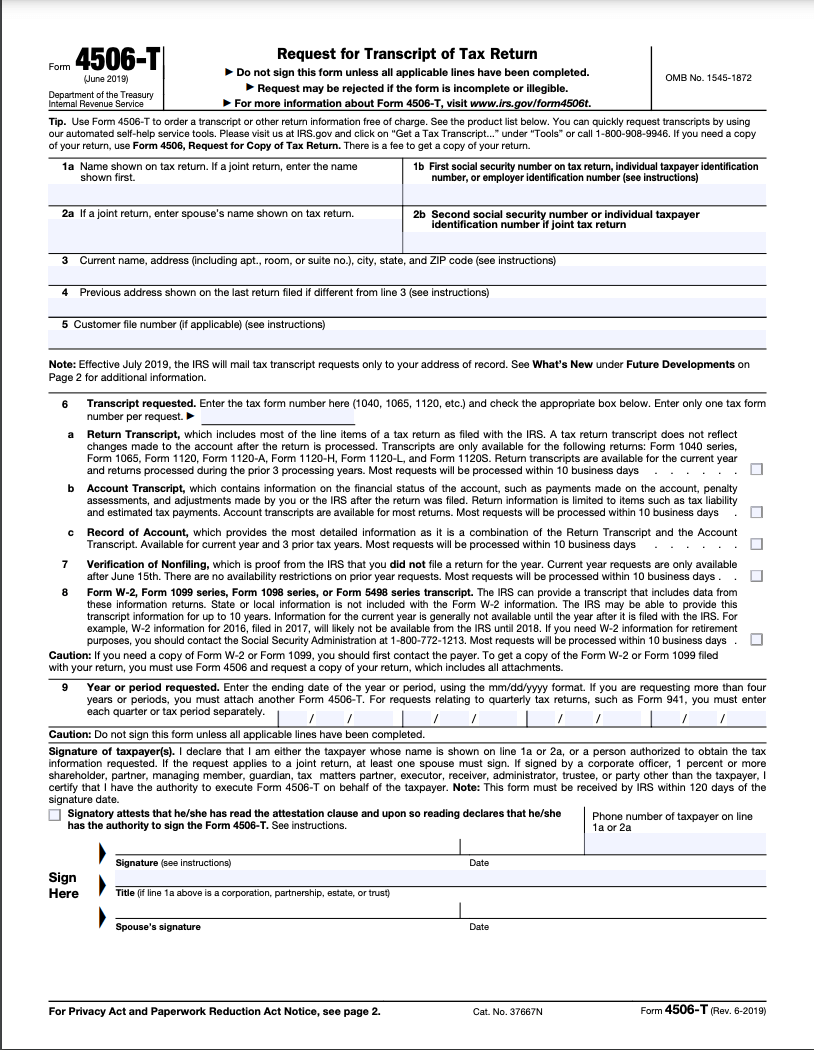

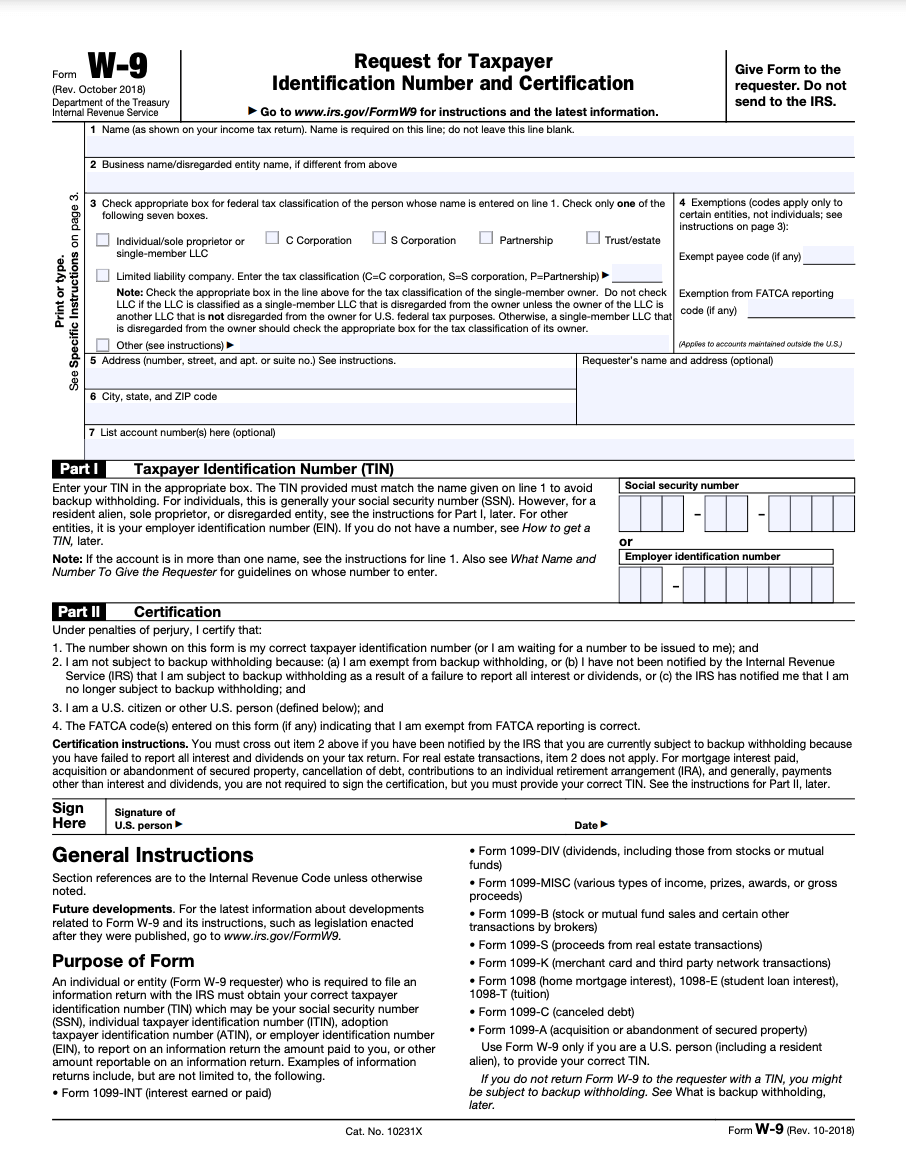

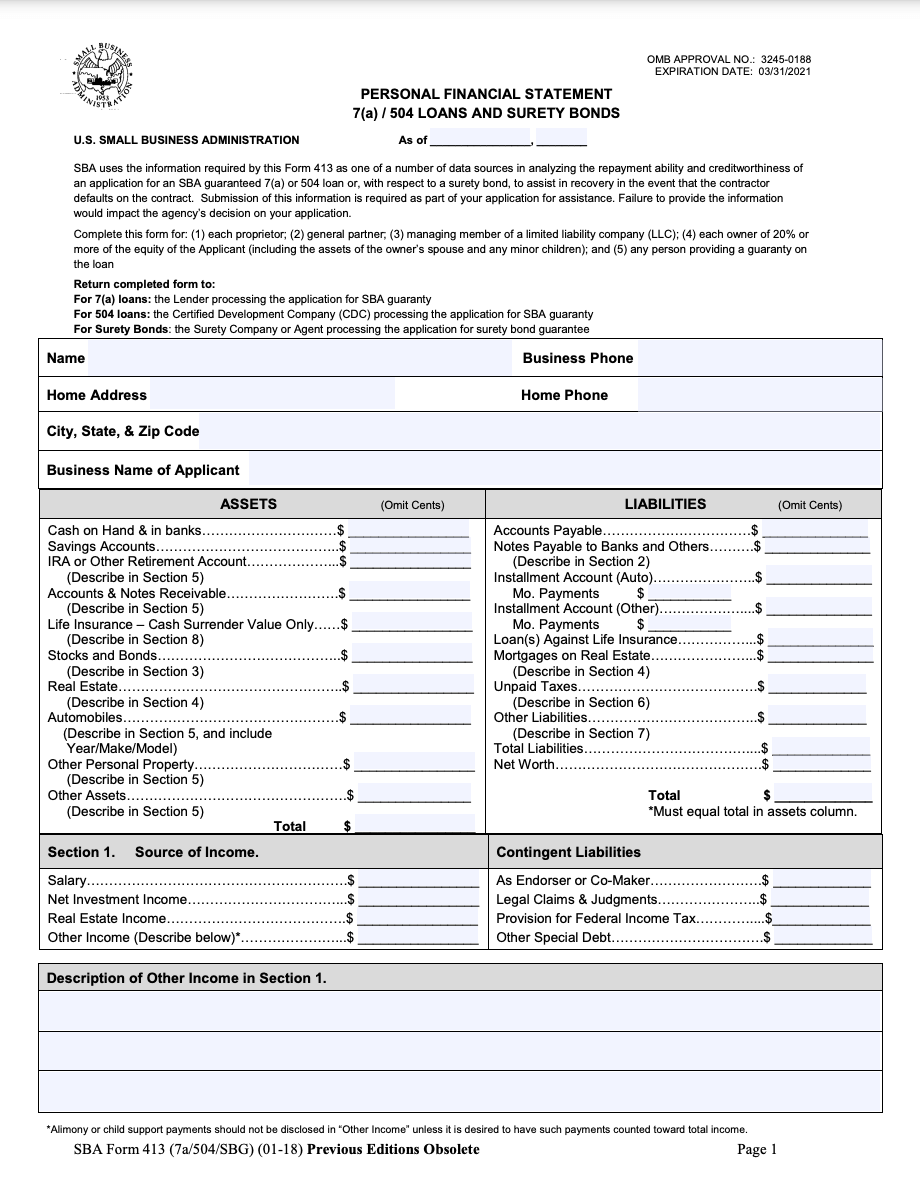

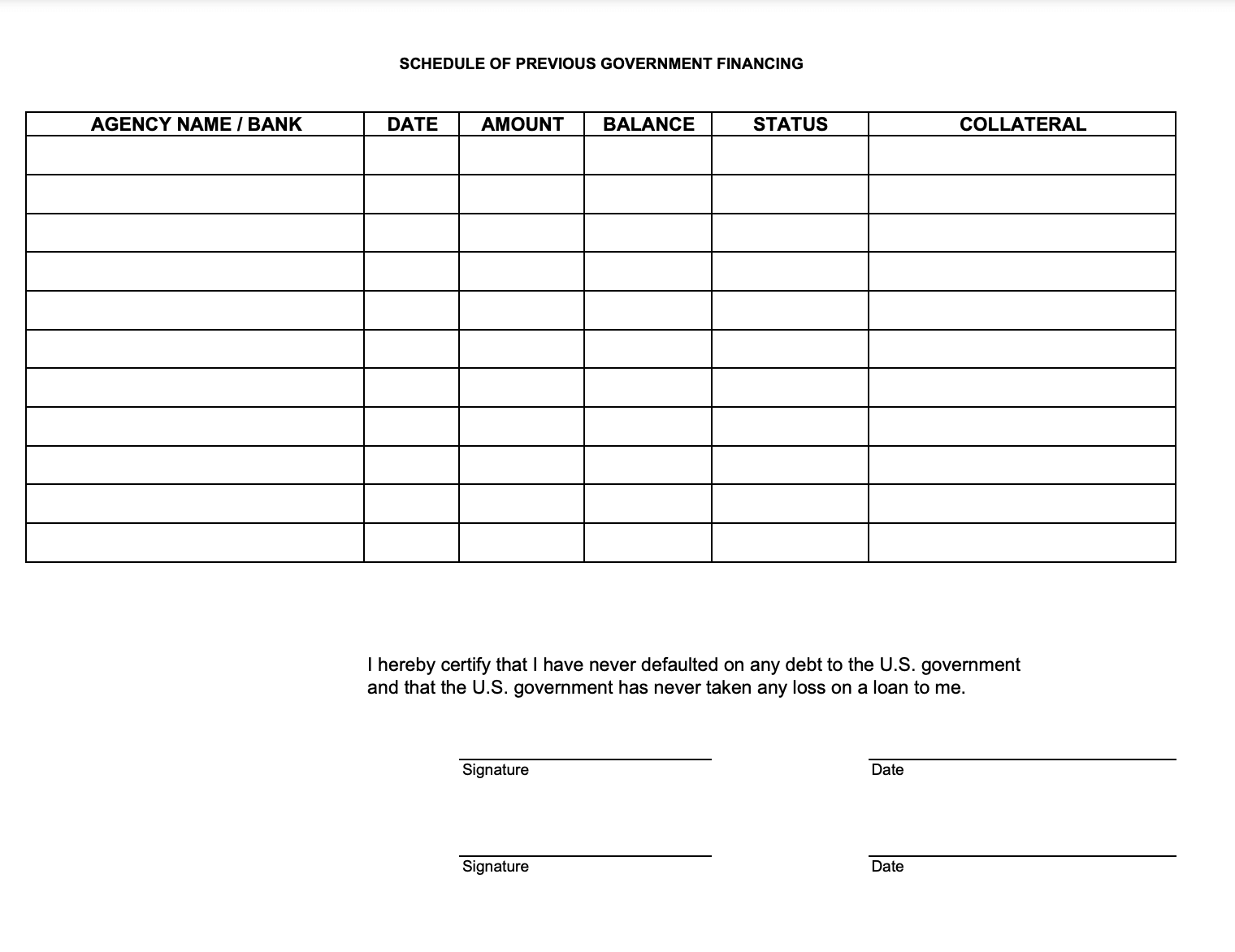

BUSINESS FORMS

APRIL 2024 INTEREST RATE

504 LOAN RATE: 6.767%

LOAN & REFINANCING PROGRAMS

City of Amarillo Community Development Micro-Loan Program

The City of Amarillo Community Development Micro-Loan Program is designed to provide small businesses with increased access to capital in the City of Amarillo. This program creates job opportunities and provides a means for businesses to grow. The City of Amarillo Community Development Micro-Loan Program will target low to moderate income individuals in the City of Amarillo.

SBA 504 Loan Program

The program is designed to enable small businesses to create and retain jobs; SBA requires TPRDC to document the small business job creation/retention and meet the standard of one job created or retained for every $90,000 of loan proceeds provided to the small business by TPRDC. This requirement is waived for loans meeting public policy goals.

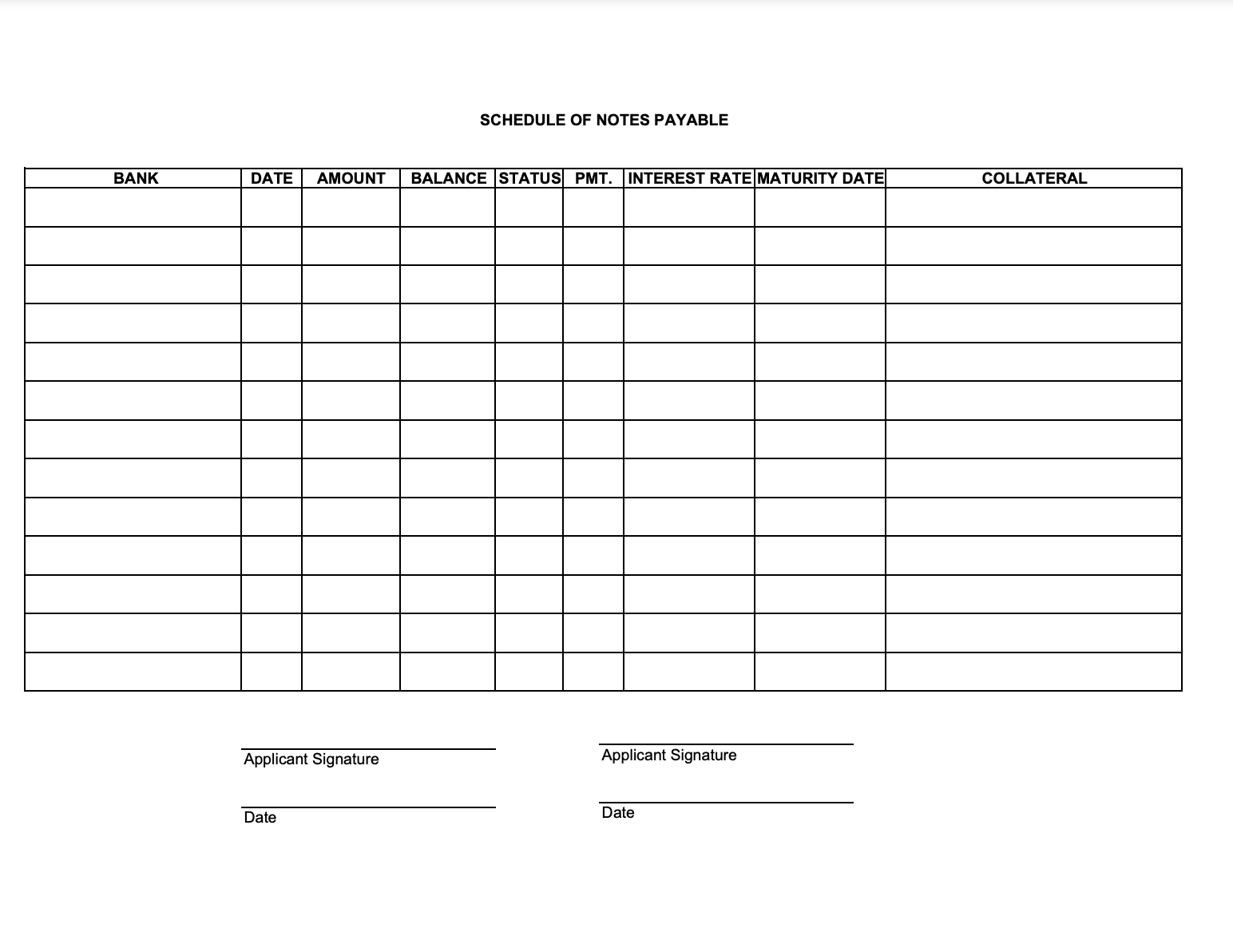

SBA 504 Loan Package Documentation Checklist

TPRDC works with private-sector lenders to provide financing to small businesses. The U.S. Small Business Administration’s 504 Loan Program enables expanding businesses or business startups to secure long-term, fixed-rate financing for major fixed assets, such as land, buildings, and/or long-term equipment through loans made by TPRDC. Applicants can reference our Package Documentation Checklist to ensure all requirements are met.